The Development Bank of South Africa (DBSA) and FirstRand use ENCORE to understand and contextualise potential nature-related risks across their investment portfolios, and integrate nature into existing risk management processes.

| User profile | Financial Services Development Bank |

| Sector | Financials |

| Scope of activities | Africa, South Africa |

| Intended use of ENCORE | Screening for potential nature-related risks across portfolios |

Case study topic:

This case study tracks the experiences of two South African financial institutions, FirstRand and the Development Bank of South Africa (DBSA), in assessing their nature-related impacts and dependencies using the ENCORE tool. It outlines why understanding nature-related risks is important in a South African context, and how two disparate financial institutions make use of ENCORE to understand nature-related risks across their portfolios.

DBSA and FirstRand are original piloting banks of ENCORE since 2018. South Africa is a Swiss State Secretariat for Economic Affairs (SECO) priority country. SECO is one of ENCORE’s original funders.

Key findings:

For both DBSA and FirstRand, ENCORE acts as a starting point for more granular assessment of nature-related risks, and opens the door for standardised risk assessment and reporting procedures across diverse portfolios. However, both institutions highlight the need for further capacity building and resources to better integrate nature into their risk assessment processes.

FirstRand business summary:

FirstRand is an integrated financial services provider headquartered in Johannesburg, South Africa. They offer transactional, lending, investment and insurance products and services to retail, commercial, corporate and public sector customers.

Development Bank of South Africa (DBSA) business summary:

DBSA is a government-owned development finance institution that aims to promote economic growth, regional integration and sustainable development infrastructure investments across South Africa, the South African Development Community (SADC) and in wider Africa. Portfolios cover sectors of importance for economic growth and development, including: IT infrastructure, transport, water and sanitation, energy, health, education and human settlements. More recently DBSA has been seeking to give more emphasis to promoting and advancing nature investments and nature based solutions.

Business Case, South Africa:

South Africa is in the top 10 most biodiverse countries on Earth, and Southern Africa harbours exceptional levels of biodiversity. The African continent has one quarter of the world’s mammalian biodiversity and one fifth of the world’s bird species. Yet the region is highly exposed to physical risks from climate change and biodiversity loss. Rapid deterioration of already dry soils is causing decline in productivity, loss of livelihoods and spread of zoonotic diseases (World Bank, 2021).

South Africa (and Southern Africa more broadly) have high profile examples of organisations affected by biodiversity loss. This results in physical and transition risks. Direct physical risks arise due to organisations’ high dependence on nature. Transition risks include reputational and regulatory repercussions as organisations are increasingly held accountable for their negative impacts on nature. For example, a Tanzanian infrastructure company recently lost a legal battle to construct a railway through the Serengeti. In the province of Mpumalanga in South Africa, coal production companies are facing increasing scrutiny by citizens and local communities for greater transparency of their transition plans to cleaner energy sources.

Nature degradation and biodiversity loss pose risks to business, local communities and livelihoods, but nature also provides significant opportunities to business and finance. Protected areas are expanding across all Southern African countries and biomes, representing opportunities for positive investment. Businesses who transition towards nature-friendly activities can also experience decreased costs through lower exposure to nature degradation and biodiversity loss.

FirstRand and DBSA have recognised the close integration of nature and climate related physical risks, and the implications nature loss can have on the financial system. For both organisations, integration of nature-related risk into the risk assessment process is a natural extension of existing climate work. It is also a means for building resilience of investments against biodiversity loss. At the same time, FirstRand and DBSA are showing leadership in using ENCORE to make nature-related risks visible in financial language, and helping to mainstream understandings of natural capital across the South and Southern African financial system.

DBSA ENCORE Analysis

Phase 1: Scoping nature-related risk and mainstreaming a nature strategy

DBSA took part in an early stage pilot of the ENCORE tool with support from PricewaterhouseCoopers (PwC) (2018). This showed DBSA’s exposure to nature-related risks across the sectors they interact with, highlighting key sectors and impact drivers to look out for in further risk assessment processes. This helped gain a broader understanding of how biodiversity risks materialise as financial risks on the organisation's balance sheet.

Following the PwC pilot, DBSA sought to understand how physical and reputational risks apply to its loan book, through assessing sectors at risk across DBSA’s portfolios using ENCORE. The results from this analysis were shared with management and the board, who were supportive of creating a more detailed nature-risk management and positive impact strategy. This involved creating a cross professional common language and understanding of nature-related risks throughout the bank, and finding ways to integrate this into existing risk management processes as well as seeking new business opportunities that promote restoring damaged ecosystems and associated livelihoods and protecting nature.

Challenge:

At the early stages of establishing the nature-risk management strategy, resourcing was a key challenge for DBSA. Applying the ENCORE tool effectively requires considerable time commitment. Initially, the bank's analysts had little time to conduct additional assessments across portfolios and DBSA’s data infrastructure had limited nature based information available. Efforts were made to tag nature based information in existing systems based on the ENCORE tool, but this was not consistently applied across the risk assessment process and was never captured in the DBSA primary information data systems (such as the South African Power Pool (SAPP) and the Development Results Framework). This made it difficult to compare nature-related risks across portfolios. This challenge has now been addressed through developing a new integrated approach. The process has been tested, and is now being circulated across the organisation for review, before presenting to management.

Phase 2: Building from ENCORE with additional tools and data

The ENCORE tool has helped DBSA to screen portfolios for nature-related impacts and dependencies at the sector and sub-sector level using a range of additional nature-based tools. This includes identifying high risk sectors and mapping the most material dependencies and impacts across these, enabling identification of priorities for further analysis.

Challenge:

While global tools such as ENCORE and the WRI Aqueduct tool provide useful information for initial assessment, they lack specific location granularity and can give a partial perspective on risks in a given regional, local or societal context. They are also weak on identifying opportunities.

The ENCORE tool has undergone several generations of improvements since DBSA first piloted it, but requires consistent updates to remain current. For example, ENCORE and other tools did not list Cape Town in South Africa as a region of high water risk, despite exposure to increasingly severe drought events since 2015. Some physical risks, which are significant in many South African contexts, such as wildfire risk, storm surges and sea level rise are also limited in scope and granularity.

The ENCORE knowledge base and the set of resources on which it draws are being continually improved. As part of their current development priorities, the ENCORE Partners are working to support banks in priority countries (Colombia, Indonesia, Peru and South Africa) with delivering more detailed national-level nature-related risk assessments. This work is funded by the Swiss State Secretariat for Economic Affairs (SECO) and will build out ENCORE’s analytical functionalities for key country-sector combinations.

Additionally, the ENCORE partners are currently receiving support from the SUSTAIN project, which is overhauling the ENCORE knowledge base on natural capital dependencies and impacts. The focus of this work is to update the knowledge base to reflect the latest scientific and empirical research and further align ENCORE with developments of major initiatives such as the Taskforce on Nature-related Financial Disclosures (TNFD).

DBSA has been supportive in improving data baselines and scenario tools for example in securing a GEF Biodiversity for Water Security Project (with the South African Biodiversity Institute as Executing Agency), which added further granularity value to the WWF Water Risk Filter tool in South Africa.

DBSA is developing a validation approach to shift analysis from the sub-sector and global level, towards project and location specific assessment. Through working with specialists and using tools such as the International Development Finance Club Biodiversity Toolkit, the TNFD and WWF Water Risk Filter (which is detailed for South Africa in particular), in the regions of financed projects, DBSA analysts are able to verify if results from ENCORE analysis (and other global tools) fit the local realities.

The alignment of a variety of tools have arrived at similar analysis and conclusions to ENCORE. Where discrepancies were found by various multifunctional teams in DBSA, a methodology to highlight corrective methods to the results from ENCORE and other tools are being systematically standardised, meaning that information is increasingly comparable across the loan book. DBSA is working through a strategy on mainstreaming this work, including expanding the range of tools and metrics used in the assessment process.

FirstRand ENCORE analysis

Phase 1: Nature-related risk assessment and education

FirstRand’s work on climate has shown a clear interface of climate-related and nature-related physical risks, meaning healthy ecosystems are essential for mitigating the impacts of climate change. Nature and biodiversity have been integrated into FirstRand’s Environmental and Social Risk Assessment (ESRA) process. A company applying for a loan will (depending on their risk rating) go through a due diligence process to assess impacts on nature, water and the wider environment. FirstRand have used the ENCORE tool to inform their ESRA process, aiding in the assessment of credit risk ratings for companies in different sectors.

FirstRand uses the ENCORE tool to raise awareness of nature-related risk for clients and internal risk assessment teams. ENCORE acts as an easy to access tool for translating impacts and dependencies on nature into exposure to potentially material risks for business and finance. FirstRand uses ENCORE data to develop guidance notes for clients and identify key issues for engagement. This helps businesses understand the importance of nature and healthy ecosystems to business activities and financial viability.

Phase 2: Heatmapping

After initial use in FirstRand’s ESRA screening, the ENCORE tool is now being used to inform FirstRand’s approach to portfolio heatmapping. This helps understanding of high risk and high stress areas within the portfolio. ENCORE is used alongside the WWF biodiversity risk filter (WWF BRF) to map impacts and dependencies, as well as potential opportunities for restorative nature-positive activities. Linked with their climate risk approach, these tools help move the balance sheet to green finance solutions, and integrate biodiversity into green finance portfolios.

Example: Agriculture Portfolio heatmapping

FirstRand have used ENCORE for heatmapping of their agricultural portfolios. This has proved useful for understanding key impacts and risks of the sector, and of particular production processes which have high material impacts and dependencies. This forms a basis to expand analysis towards location and commodity specific assessments of portfolio companies.

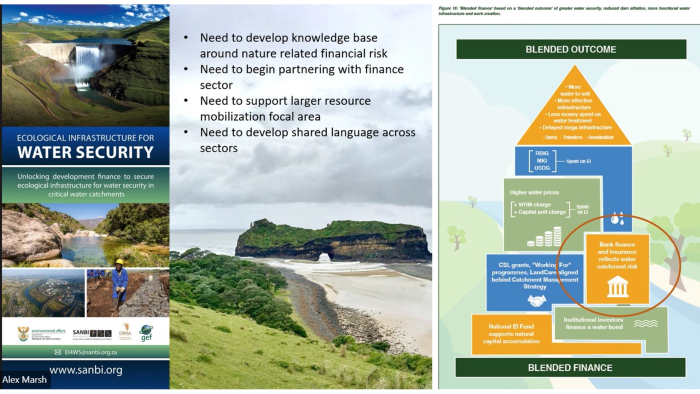

In South Africa, location specific assessment is important as environmental issues vary significantly between regions. For instance, water risk in the north of the country is very different to that in the south. ENCORE data is complemented by regional specific information sourced from the South African National Biodiversity Institute (SANBI). Similarly, agricultural commodities have varying impacts, and some are associated with particularly high nature-related risks (see SBTN High Impact Commodities List). ENCORE helps identify key issues, before adding location and commodity specific data layers and tools (e.g. the Integrated Biodiversity Assessment Tool (IBAT), WWF Biodiversity Risk Filter (BRF), South African National Biodiversity Institute (SANBI) data).

Moving forward, FirstRand wants to integrate client level information to improve the risk assessment process for client specific activities, yet this requires improvements in data availability. They also plan to use scenario analysis to inform where nature-related risks might be amplified by climate risks, with regional specific scenarios that take the South African context into account.

Conclusion

Both DBSA and FirstRand use the ENCORE tool as a first step for understanding and contextualising potential nature-related risks across their investment portfolios, and integrating nature into existing risk management processes. In doing so, they act as leading examples for making nature risk visible to financial institutions and business in a South African context.

In order to achieve Target 15 of the Kunming-Montreal Global Biodiversity Framework, both organisations understand the importance of integrating TNFD reporting into their nature strategies, and mainstreaming nature reporting across South Africa. The FirstRand Group are piloting the TNFD framework, and are similarly a member organisation of the TNFD Taskforce. DBSA has also assisted TNFD to pilot its framework and found it valuable in pulling together a variety of available tools into a simplified and effective framework including the ENCORE tool. ENCORE acts as a first step for financial institutions to assess nature-related risks across their portfolios, which can inform further nature-related risk assessment and support TNFD disclosures.