About Nest

Nest (National Employment Savings Trust) is a UK-based workplace pension scheme with over 13.7 million members and GBP 48.1 billion assets under management (AUM) as of 31 December 2024. Its investment portfolio spans various asset classes, including listed equities, bonds, property, infrastructure, and private credit and equity all around the world. Nest works with 18 asset managers to invest on their behalf and does not manage any investments in house. Nest places a strong emphasis on responsible investment, integrating environmental, social, and governance (ESG) considerations into their strategy, to support its members' retirement outcomes.

From 2023 to 2024 Nest partnered with the Oxford Sustainable Finance Group to analyse nature-related financial risks and physical climate risk across their portfolio, to inform their new and updated environmental risk policies. The results presented in this case study were generated as part of this collaboration.

Objectives

Nature and biodiversity loss are increasingly acknowledged to pose material, systemic financial risk for pension funds and their members. Nest wanted to understand their exposure to nature-related financial risks across their portfolios to inform their first nature and biodiversity policy, which is currently being drafted.

Approach

In 2024, Nest conducted a risk screening analysis using the updated ENCORE knowledge base to assess its potential exposure to nature-related financial risks in their investments. ENCORE was chosen as a tool because of its transparent and open-source methodology and because it was straightforward to combine with holdings (industry) data that were available to Nest. The analysis was performed for the investments within the public equities and bonds portfolios which make up more than 70% of Nest’s total assets under management (AUM). For other asset classes, sufficiently granular industry data for individual investments was not readily available. Exposure was analysed for direct operations and for tier 1 and tier 2 upstream value chains*. Upstream value chains were prioritised as both the influence of portfolio companies to drive change and materialisation of exposure into financial risk was deemed higher.

*Upstream tier 1 value chain links cover sectors that supply directly to organisations with direct operations in a sector. Upstream tier 2 value chain links cover sectors that supply to tier 1 suppliers.

The analysis looked to answer:

- Which sectors and companies within the portfolio have the highest potential dependencies and pressures on nature through direct operations? Both in terms of number of potential dependencies and pressures and materiality of the dependency or pressure.

- What level of exposure do Nest portfolios have to these sectors and companies? How does this exposure profile evolve when upstream tier 1 and tier 2 value chains are considered?

- Which ecosystem services are most important for Nest’s investments’ direct operations? To which type of nature pressures do Nest investments’ direct operations potentially contribute the most?

- Which ecosystem components do these most material ecosystem services and pressures depend on / affect?

The analysis consisted of 4 steps:

- Collecting, cleaning, and formatting of portfolio holdings data : For each of Nest’s public equities and bonds portfolios, lists with individual securities were extracted with the total amount invested in each and the industry they belonged to. This industry data was then converted into the most appropriate International Standard Industrial Classification of All Economic Activities (ISIC) categories to allow matching with the ENCORE knowledge base.

- Processing ENCORE information and mapping to holdings: Portfolio holdings were aggregated at the sector level which were then mapped against the ENCORE knowledge base, by consolidating data from different ENCORE spreadsheets and matching sectors with ecosystem services/pressures to ecosystem components.

- Defining ‘materiality’: A dependency or pressure for a sector was defined as ‘material’ where ENCORE data shows a high (H) or very high (VH) materiality relationship.

- Analysing implications for Nest portfolio: Data analysis and tailored visualisations of the screening exercise were generated in order to ascertain the implications on Nest's investments, as outlined above.

Note: One challenge that was encountered during step 2 was that portfolio holdings sometimes only had sector information available at the ISIC ‘Division’ or ‘Group’ level, whereas the ENCORE database provides materiality ratings at a more granular ISIC ‘Group’ or ‘Class’ level. In this case the maximum materiality value from across all lower tiers of that sector was selected. For instance, where a holding was under the Manufacture of beverages sector (ISIC group level), the maximum materiality value for each ecosystem services was selected from across the 4 ISIC classes that are part of this group: Distilling, rectifying and blending of spirits; Manufacture of wines; Manufacture of malt liquors and malt; Manufacture of soft drinks; production of mineral waters and other bottled waters. Maximum values were selected rather than average values to maintain the comparability and interpretability of the values.

Key findings

Nature dependencies and pressures were identified for all sectors in Nest’s portfolio that were covered in the analysis.

Dependencies

- Overall, 31% of investments have at least one material dependency on nature in their direct operations.

- Investments in the manufacturing, power, mining, and real estate sectors represent the most material exposures to direct nature dependencies.

- Exposure to material dependencies increases significantly when upstream Tier 1 and Tier 2 value chains are considered (Fig. 2 and Fig. 3).

- Exposure to material dependencies was greatest for water-related ecosystem services in direct operations. In Tier 1 upstream value chains exposure to ’Visual amenity’, ’Education, scientific and research’ and ‘flood regulation’ increases significantly (Fig. 1 and Fig. 2).

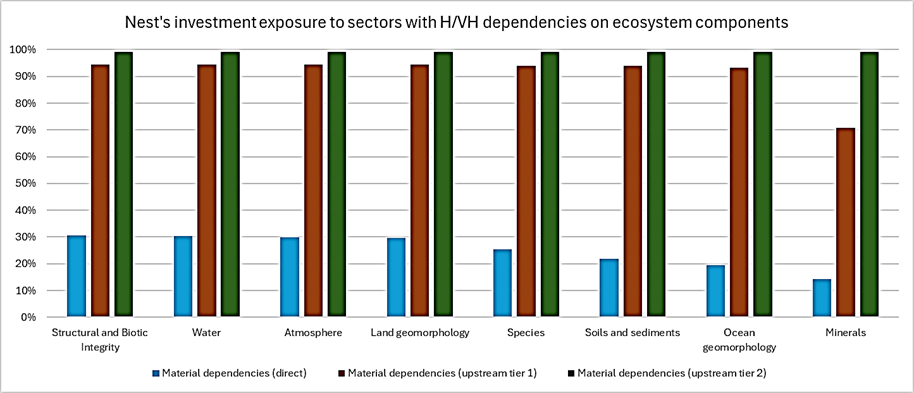

- Most ecosystem components or natural capital assets are equally important for the ecosystem services that Nest portfolio companies rely on most (Fig. 3).

Figure 1. Nest’s investment exposure to sectors with material dependencies on nature (within direct operations) for the 10 ecosystem services with highest AUM exposure

Figure 2. Nest's investment exposure to sectors with material dependencies on nature within direct operations and upstream value chains (Tier 1 and Tier 2) for the 10 ecosystem services with the highest AUM exposure

Figure 3. Percentage of Nest’s investments with material dependencies on ecosystem components within direct operations and upstream value chains (Tier 1 and Tier 2)

Pressures

- Overall, 38% of the investments in the analysis have at least one material pressure on nature in their direct operations.

- Investments in the manufacturing, power, mining, and transport sectors represent the most material direct nature pressures in the analysis.

- Exposure to material pressures increases significantly when upstream Tier 1 and Tier 2 value chains are considered. (Fig. 5 and Fig. 6).

- The most material nature pressures in direct operations are linked to toxic soil and water pollutants, disturbances and non-GHG air pollutants. In Tier 1 upstream value chains exposure to ‘introduction of invasive species’ and ‘emission of GHG’ increases. (Figs.4, 5)

- Ecosystem components, or natural capital assets, that are most impacted by the portfolio’s material pressures are ‘species’, ‘structural and biotic integrity’ of ecosystems, ‘soils and sediments’, and ‘water’ (Fig. 6).

Figure 4. Nest’s investment exposure to sectors with material pressures on nature (within direct operations) for the 10 pressures with the highest AUM exposure

Figure 5. Nest’s investment exposure to sectors with material pressures on nature within direct operations and upstream value chains for the 10 pressures with highest AUM exposure

Figure 6. Percentage of Nest’s investments with material pressures on ecosystem components within direct operations and upstream value chains (Tier 1 and Tier 2)

Limitations of the analysis

ENCORE offers an easily accessible way to screen for nature-related risks from a top-down industry view. The analysis provides a useful starting point, identifying priority sectors and areas to analyse further. Nest faced two main limitations in the above analysis.

- It is difficult to access sufficiently granular (sector) data for the individual companies within Nest’s different investment funds. This includes (lack of) access to revenue data per sector, product, or service type for individual companies, or access to (different) sector classification systems which require conversion to the ISIC system used in ENCORE. The challenges with mapping the ENCORE databases onto Nest portfolios mean that any analysis will include both over- and underestimations at the individual company level. Additionally, the use of maximum materiality values where ENCORE provided greater sectoral granularity than available at the holding level, introduces overestimates for certain sectors.

- The ENCORE knowledge base itself, as it is location and context agnostic, assesses potential dependencies and pressures at the sector level, therefore this analysis does not take into account conditions at the individual company level. It does not provide information to which extent each dependency or pressure actually materialises for any given company or how a company may be mitigating these. This means that the analysis should only be used as an exposure assessment of the dependencies and pressures at the portfolio level and cannot be interpreted as a full risk assessment. Further analysis is needed, taking into account individual companies’ geographical footprint, operational practices, and mitigation actions to build a picture of risk.

Outcomes and next steps

Overall, the assessment confirms the systemic character of nature-related financial risks for a global investor such as Nest. While it will be challenging to diversify their investments away from material nature dependencies or pressures, the assessment highlights some priority sectors and topics for further analysis.

This assessment will inform Nest’s first position paper focused on nature which is currently in development. This position paper will set out Nest’s approach to considering and integrating nature and biodiversity-related risks and opportunities through the different investor levers at their disposal, including risk management and asset allocation, fund manager selection and monitoring, stewardship, and supporting public policy.

The ENCORE tool has enabled Nest to kickstart its nature journey in a more informed way through a straightforward exposure mapping and screening exercise, helping to identify priority sectors and issues for further analysis across a highly complex topic. The analysis was being used within Nest’s latest responsible investment report , to inform their stakeholders, including its pension members, about the importance of nature within their portfolio. It cements nature and biodiversity as key ESG priority issue for engagement, voting, capital allocation and more. Next, Nest will work closely with its asset managers to implement its new nature and biodiversity policy and inform investment and engagement activities.

Acknowledgements

This case study was produced by the Oxford Sustainable Finance Group and reviewed by Nest and the ENCORE Partners.