Robeco is an international asset management organisation based in The Netherlands, managing over €176bn EUR of ESG-integrated assets.

This case study summarises Robeco’s use of ENCORE as an initial screening tool for understanding its exposure to nature-related impacts and dependencies. This assessment acted as a springboard for developing its own in-house assessment and biodiversity investment framework.

Business case

The financial sector and the asset management industry have a crucial role to play in halting nature and biodiversity loss. A healthy planet is in the long-term interest of our clients and our investment performance, along with our duty to do our best to use our leverage and influence to contribute to protect the planet.

Robeco

In 2021, Robeco conducted a heatmap assessment using ENCORE to assess its exposure to nature related risks through its investments. This acted as a starting point for developing a biodiversity investment framework for assessing portfolio companies’ contributions to the drivers of biodiversity loss, and the strategies they had in place to mitigate nature-related impacts. Robeco plans to use the investment framework to feed into a range of nature-related strategies, including nature-related investment products, assessment of exposure to nature risk, and to inform engagement activities with portfolio companies.

ENCORE assessment

Robeco conducted a heatmap assessment using ENCORE data to understand the exposure of its investments to sectors with high or very high impact on nature and dependency on ecosystem services. It focused its assessment on two asset classes - fixed income and equities. This analysis allowed Robeco to identify sub-industries with the highest exposure to dependencies on ecosystem services and impacts on key drivers of biodiversity loss. The results were comparable to the findings from research by the Dutch and French central banks and other peers in the industry.

Some of the key insights from the analysis include:

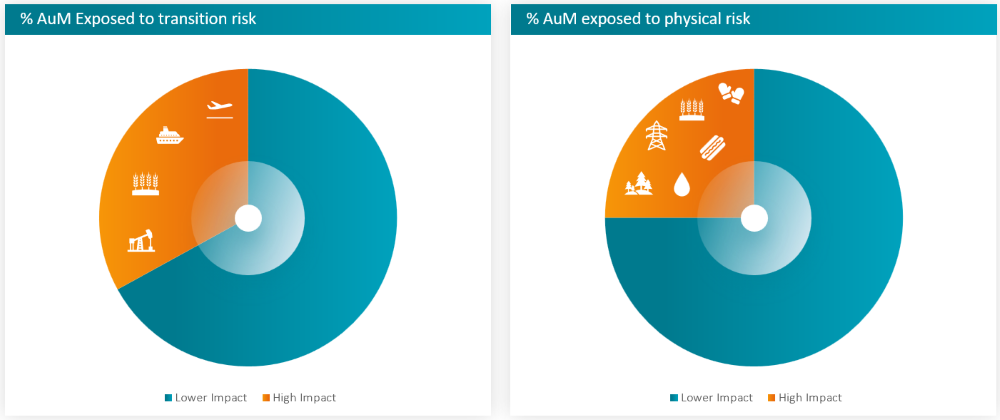

- Around one-quarter of Robeco’s assets under management (AUM) are in sectors that are either highly or very highly dependent on at least one ecosystem service. These include Agricultural Products, Forest Products, Electric & Water Utilities, Packaged Food and Meat, and Apparel (Figure 1).

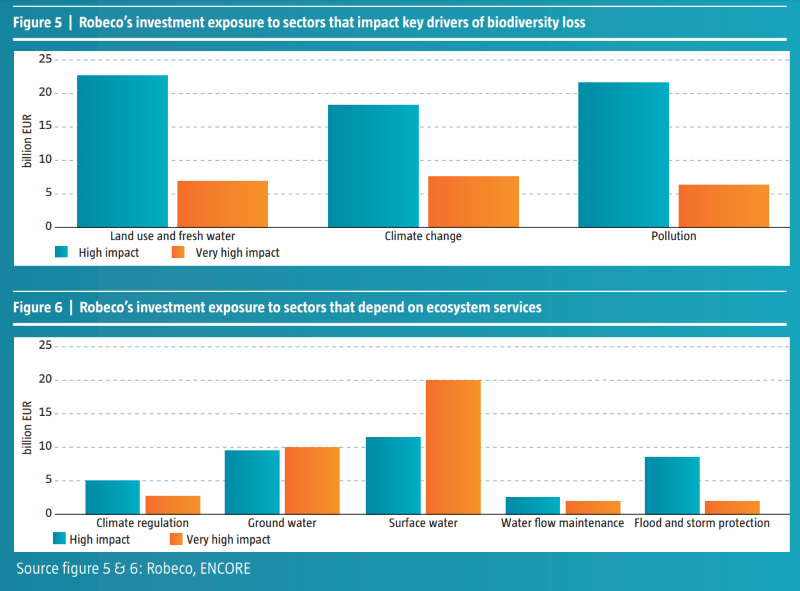

- The provision of ground and surface water alone proved to be the most material, followed by climate regulation and water flow maintenance (Figure 2).

- Around one-third of investments are in sectors that have potentially high or very high impacts on key drivers of biodiversity loss (Figure 1). These sectors are Airlines and Airport services, Marine ports, Agricultural products, and Oil & Gas.

- Use of land and freshwater were identified as the largest potential impacts, followed by climate change, pollution and direct disturbances (Figure 1).

Figure 1: Robeco’s AuM exposed to high or very high impacts and/or dependencies on nature.

Source: Robeco.

Figure 2: Robeco’s investment exposure to sectors that impact on key drivers of biodiversity loss (top) and depend on key ecosystem services (bottom).

Retrieved from page 11, Robeco's approach to biodiversity white paper.

Limitations of analysis

While ENCORE was a useful first step in mapping its exposure to biodiversity risks for a top down industry view, Robeco found two key limitations: it cannot be applied to sovereign issuers and because ENCORE data focuses on sectors and industry types, its data cannot be used to assess how individual companies impact and depend on nature or what actions they are taking to mitigate their risks.

In response, Robeco reviewed the available ESG datasets for company-level exposure to impacts and dependencies along value chains. However, this data still lacks insights into companies’ responses to existing nature related risks, such as taking mitigating and remedial action. Therefore, Robeco created its own biodiversity investment framework to assess companies’ nature-related impacts. The framework contains indicators based on the drivers of biodiversity loss identified by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) (excluding invasive species) and consistent with the TNFD approach.

Companies are scored based on how they are contributing to or relieving pressure on the drivers through their products, direct operations and across value chains. The assessment also takes into account company commitments and strategies as well as evidence of controversies and misbehaviors. Company scores enable Robeco to differentiate between leaders and laggards when it comes to their contribution and efforts to relieve pressures on drivers of biodiversity loss.

Outcomes

Robeco’s journey to understand its impacts and dependencies on nature began with mapping its investment exposure using ENCORE. While useful at the sector level, the need to assess nature-related risks at the company level was clear, which triggered the development of its Biodiversity Investment Framework. The framework is being used to map companies’ performance across investment portfolios. The results will feed into a number of actions including nature related investment products, provide insights to investment teams on their exposure to nature risks, and to inform engagement activities with portfolio companies.